USAA locks your rate for 45 days, so you'll be able to shop around for 45 days with a loan already sitting comfortably in your virtual pocket. The platform offers a lease buyout. They do not penalize you for paying off your loan early.

The site only serves people with ties to the armed forces.

If you are in any way, shape, or form related to the United States Armed Forces, the platform in question is easily the best car loan service for you. And if that isn't the case, we're afraid you're all out of luck.

3.09%

3.79%

None

84 months

Minimal (usually between 5 minutes and an hour)

None

None

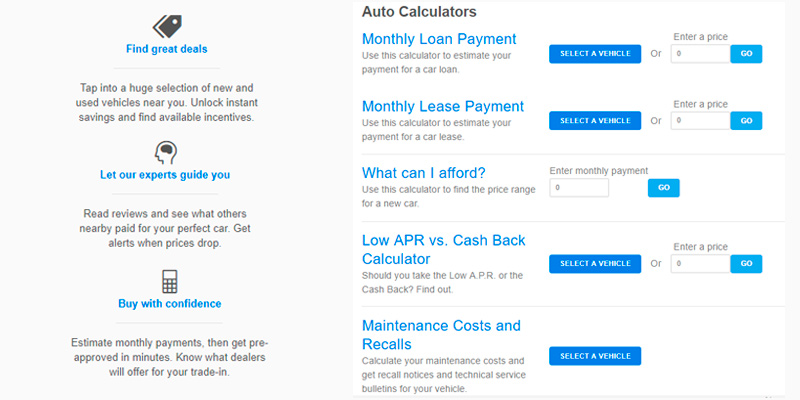

Using the auto loan calculator, you'll be able to estimate a monthly loan payment, monthly lease payment, whether you should go for a low APR or a cash-back option, and so much more.

The company itself isn't a loan provider.

If you don't know what you want out of your next car, we couldn't recommend Edmund highly enough. Their comprehensive search engine and remarkable tools will match you with your perfect vehicle. After that, they will help you find the best deal on the car and the loan.

Varies

Varies

Varies

Varies

3-5 minutes

Varies

Varies

LendingTree will find you offers from multiple lenders, so you'll have the opportunity to choose the one with the best rate and terms. Their platform posts arguably the most appealing used car interest rates.

Multiple offers will often require multiple hard credit pulls.

LendingTree, technically speaking, isn't a loan provider itself. That said, this is still one of the better companies to go for if you need a car loan. The people behind this platform will definitely help you find the best value. Plus, their online application form is simple and intuitive.

3.99%

3.19%

18 months

84 months

1 day

None

Varies

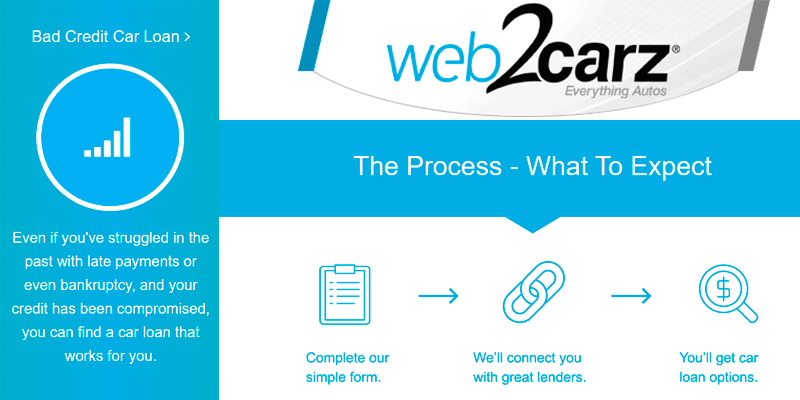

Web2Carz works with all levels of credit score and has a 99% acceptance rating. Though the site itself is inconsistent at times, the application is free, easy, and straightforward.

The website is a little frantic and the navigation leaves a lot to be desired.

While flawed, Web2Carz has its moments. You can use the website to acquire a new car or a used one. You can use it to sell your car. You can go there to shop, compare, and acquire car insurance and warranty. Plus, it is still the best car loan service for people with a bad credit score.

Varies

Varies

Varies

Varies

Varies

Varies

Varies

The company's trained specialists will help you choose the right car deal. They will find you a suitable flexible option and the best loan term. On their website, you will find a comprehensive FAQ section. They do not take a broker fee and they never match you with the companies that require a deposit beforehand.

The interest rates are relatively high.

Сar Finance Deals is a pretty good car loan option for those people who do not want to waste their time with financial questions. They will find a loan for you and they will do that in no time at all. Aside from cars, they will help you find a deal for a motorbike or even a boat.

6.9% (varies between different lenders)

6.9% (varies between different lenders)

12 months

60 months

5-10 minutes

Varies

Varies

This site is a free online resource that strives to offer helpful content and comparison features to its visitors. Please be advised that the operator of this site accepts advertising compensation from certain companies that appear on the site, and such compensation impacts the location and order in which the companies (and/or their products) are presented, and in some cases may also impact the scoring that is assigned to them. The scoring that appears on this site is determined by the site operator in its sole discretion, and should NOT be relied upon for accuracy purposes. In fact, Company/product listings on this page DO NOT imply endorsement by the site operator. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information which appears on this site is subject to change at any time. More info

USAA Auto Loan

Customers First

The United Service Automobile Association (USAA for short) is one of the most customer-friendly and convenient online car loan services on the market today. Their platform checks all of the usual boxes: the annual payment rates are low, they do not discriminate that much between new and used cars, the company is liberal enough with their credit history approach, and the process of acquiring the loan seldom takes a whole lot of time.

Now, let's get a little more specific. First and foremost, USAA is a reputable company with a great reputation. Their practices are about as transparent as it gets. There are no application fees, so it won't cost you anything to find out how much you qualify for. They aren't in the business of hiding fees, so you know the exact number that you pay.

Hoping for the best and preparing for the worst is always the best long-term strategy as you never know what the future holds and where your life might take you. With USAA, you'll be able to do just that. Dissimilar to the absolute majority of its competition, the company offers payment deferment options in case of a natural disaster.

Saves Time and Money

Time is the ultimate luxury. You can't purchase it, so you ought to be smart with how you spend it. The folk at USAA understand that, so they don't waste any more of your time than it is necessary. They make fast credit decisions. Their application usually takes no more than a few minutes. All in all, their process saves you both time and money before you go to the actual dealer. Furthermore, you can go through and fill out the application via your smartphone, even while standing next to the deal at your local dealership.

As it is usually the case with these services, your annual percentage rate depends on your credit history. If you have a good history, you'll get an interest rate as low as 3.09% per year for a new car and 3.79% for a used one. To be clear, any car purchased via a car buying service since 2017 is considered a new one, while anything bought in 2016 or before that qualifies as an older model.

Lock Your Rate

One thing that we really like about USAA is that they lock your rate for 45 days. You apply for a loan, you get that loan check and, et voila, you can shop around for 45 days with a loan already sitting comfortably in your virtual pocket. Just like the majority of auto loan services, their platform offers a lease buyout. If you happen to be really fond of your leased automobile, they will help you buy it. With their loans, you'll also be able to acquire a car from a private seller and not a registered car dealership.

The company's terms are nothing if not flexible. You can get a load for a maximum of 84 months where you won't have to buy anything for the first 2 months.

Pre-payment penalties are a joke. Why punish someone for giving you the money earlier than necessary? USAA doesn't do that. The people behind it will never penalize you for paying off your loan early.

Last but not least, the company supports their disabled customers with personalized and sparing loan options. So, considering all of the above, why would anyone settle for any other platform if USAA is so exceptional? Well, it is actually rather simple.

Unfortunately, USAA products are only available to the association members and their immediate families and the only people who qualify for this membership are those who're in the armed forces. With that in mind, the choice here is simple. If you are in any way, shape, or form related to the United States Armed Forces, this is the best car loan service for you. If not, sorry, you're all out of luck.

Edmunds Auto Loan

Choose Your Type

Edmunds Auto Loan, despite the name, isn't necessarily an auto loan service. A more accurate description of their platform would be something along the lines of an all-in-one car acquisition destination. They don't give out loans themselves. But the company does offer an array of different extra services and definitely deserves a spot on our list.

The best part of this website is easily its search engine. With it, you'll be able to find your perfect car in no time at all. First of all, you can browse by type. Choose SUV, sedan, electric, hybrid, crossover, convertible, hatchback, coupe, or a truck and their search engine will give you a myriad of potential options. After that, all you have to do is compare features, road tests, and other parts of the deal.

Of course, we've seen services like that before. They aren't exactly a dime a dozen but it is nothing out of the ordinary either. Sure, the one in question may be more accurate, more comprehensive, or just better executed in general. But that alone wouldn't be enough to warrant a spot on our list. But wait, there's more.

Find Your Perfect Car

Say you don't know what it is exactly you're looking for. Say words like "crossover" or "SUV" don't mean that much to you or you don't necessarily see the difference. Sounds familiar? Well, even if it doesn't, we would still be remiss not to mention the second best part of this platform and arguably its biggest selling point - the "find your match" tool. On paper, the tool is really simple, though there's definitely nothing simple about its implementation and execution, otherwise, most similar companies would have been able to successfully copy it.

Now, what the tool boils down to is essentially a choice of 3 different options. First, you'll have to specify what you need the car for by choosing one of the 3 available options - Family, Commuting, Hauling. Then, you'll be able to choose between Style, Large, and Economy to let the tool know what it is that you value most in a car. The last order of business is the budget. This one, as you'd imagine, is fairly straightforward. You can go with Less than $25k, $25k - $35k, and $35k or more and it will factor into the search engine's decision.

Auto Loan Calculator

Alright, so you've figured out the car that you're looking for. What's next? Well, now it's the time to actually find the car, duh. Don't worry though, with Edmund, it won't prove much of a challenge. The platform will allow you to tap into a great selection of new and used cars near you. It will also let you unlock instant savings as well as find available incentives.

You did that but you've no idea what you ought to be paying for the car? Not a problem. Just let the company's experts guide you. On their website, you can go through countless reviews and see the price that the people nearby paid for this future vehicle of yours. Plus, you can set it to send you alerts when prices drop.

Finally, there is the actual loan. And, again, Edmund won't give you a loan, that's just not what they do. However, using their thorough and comprehensive auto loan calculator, you'll be able to estimate monthly payments and get pre-approved in a matter of minutes. After that, the website will let you know what the local dealers are willing to offer for your trade-in. By the way, aside from a monthly loan payment, it calculates a monthly lease payment, whether you should go for a low APR or a cash-back option, and so much more.

Long story short, if you don't know what you want out of your next car, we couldn't recommend Edmund highly enough. Their comprehensive search engine and remarkable tools will match you with your perfect vehicle. After that, they will help you find the best deal on the car and the loan.

LendingTree Auto Loan

Choose The Best Deal

LendingTree is one of the best all-around services on the market right now. But, again, it isn't, strictly speaking, a car loan platform. However, you shouldn't let that discourage you. LendingTree themselves won't provide you with a loan, sure. However, the company works with a lot of different lenders, including your local banks and a variety of large institutions. Using their services, you will always be able to find a loan, even if your credit history is straight-up awful. What's more, more often than not, they will match you with the best possible deal. Because they don't loan money themselves, the terms, rates, and car requirements depend on the actual lender.

Now, a deal like that may sound like a disadvantage but we would say it is the opposite of that. With other vehicle loan platforms, you will often have to settle for a greedy interest rate, awful loan terms, and the most ridiculous car requirements limiting your range of options. With LendingTree, on the other hand, you will get multiple offers from different lenders, so you'll be able to choose the one that fits you the most.

Great Used Car Rates

For the most part, the platform will give you good rates. But they aren't different from any other company as far as the approval procedure is concerned. The company advertises a rate of 3.99% for new cars and 3.19% for used ones. This is way below average but we wouldn't go as far as to claim that these are the most affordable rates on the market right now. The used car rate could be close to that but you could theoretically find a better deal for a new car.

On top of that, these numbers are representative only of the best-case credit score scenario. To get rates like that, you will need a score of over 800 and that just isn't realistic for most people. Different lenders may also take into account your monthly income, your state of residence, and the type of car you're interested in.

When you actually apply for a loan, the lender almost always does a hard pull on your credit. As you probably know, this tends to have an effect on that credit score of yours. Fortunately, the credit bureaus operate by combining each hard pull that was made over a 14-day period into a single pull. That means you'll be able to shop around without making any kind of noticeable impact on your credit score.

Refinanced Loans are the Way to Go

One of the biggest advantages of this type of platform is that you're able to get just about any car that you want. The majority of individual lenders tend to incorporate a number of different restrictions, especially on the age or mileage or your future car. That isn't the case with LendingTree. Since it gives you a network of lenders, you'll always be able to find an option that suits your car.

Sure, certain companies will charge you a higher interest rate if you choose to go with an old vehicle or a car that has a particularly high mileage but spend some time and you'll definitely manage to find the right deal.

Other than that, their platform will allow you to refinance a loan. If you've been able to improve your credit score since you first took the loan, that refinanced option will offer a much better deal.

To sum it all up, LendingTree, technically speaking, isn't a loan provider itself. Nevertheless, this is still one of the better companies to go for if you need a car loan. The people behind this platform will definitely help you find the best value. Plus, their online application form is simple and intuitive.

Web2Carz Auto Loan

Honest Business Practices

Being in a bad financial situation isn't one of the more pleasant experiences, let's just say that. There's a variety of reasons for that and most of them are obvious enough. One of the worst parts of this experience, however, is the fact that you tend to get charged the most ridiculous interest rates. Of course, nothing about that is fair. Just because you filed for bankruptcy once or your credit history could use some improvement doesn't mean that you ought to be treated differently from the rest. Fortunately, that's not the business Web2Carz are in. The company claims that they put people first and, for the most, it really shows.

Now, we aren't saying that it doesn't have its flaws. No, there are definitely a couple of things about this platform that we aren't head over heels about, let's just say that. For one, the interface is a little clunky. It can be difficult to navigate. Of course, these aren't that big of a deal. For the most part, these little flaws do not affect the overall experience. What we really don't like, however, is the fact that you can't review loan offers online. Instead, you have to wait for a lender to contact you in order to hear its rates and terms. It might not bother some people but we find it a little inconvenient.

Bad is the new Good

So, what Web2Carz is exactly? Well, sticking with the theme, it isn't necessarily an auto loan service. Don't get us wrong, it will definitely help you find a suitable option and a great deal. They just don't issue loans themselves. Rather than describing the website, we would refer to their slogan (Everything Auto) because, honestly, it just about covers it. As we said earlier, you can use their platform to get yourself a car loan. Just like most similar resources, Web2Carz is perfectly fine for people with a good credit score. It will help you get a loan for a used car or a new one.

But very few of these websites are as good as the one in question when it comes to dealing with subprime credit scores. They will either refuse to loan you money altogether or try to bamboozle you with awful interest rates, no payment flexibility, and bad terms, and all kinds of penalties. Web2Carz do not do that. They're very thorough with their network and they always do their best finding the best possible deal for people with a bad credit score.

More Than Just Loans

There's a good chance you already have a loan. Problem is, a lot of people get into these situations with a subpar credit score, so they get dealt a bad hand. With Web2Carz, that isn't an issue. Use their Auto Refinance tool and you might just be able to get a lower rate or improved loan terms. The application is free, you'll be able to quickly fill it out, and it usually takes just a few minutes to get approved. Depending on your credit score, you could refinance up to 60 months, with an interest rate as low as 1.99%.

When Web2Carz says "Everything Auto", they mean it. Don't need a car loan? Fine. Don't want to refinance? That's fine as well. Using their platform, you'll have the opportunity to find yourself a new or used car. It will help you sell your car. You'll find plenty of car reviews. Plus, you can go there to shop, compare, and acquire car insurance and warranty.

All in all, as a car loan platform, Web2Carz has its flaws. Fortunately, it is so much more than that. You can use the website to help yourself with just about any car-related issue. Plus, it is easily one of the better platforms for people with a bad credit score.

Сar Finance Deals Auto Loan

The Good Kind of Broker

Сar Finance Deals calls themselves the country's most beloved car finance broker service. Well, let's just say that it might be a bit of an exaggeration. Don't get us wrong, their platform has quite a lot going for it and we will try to cover most of it in a moment. Just that they certainly have their flaws either. We don't want to focus too much on the negative side here as, again, this is a good platform. But their rates aren't always as attractive as one would hope for.

As they say on the website, Сar Finance Deals are a credit broker company. They aren't lenders. That means the rates you get depend on their persistence and business acumen as much as it does on the actual car loan companies. On average, their interest rates for a new car start at 6.9% and go up from there, which isn't that bad but also not the numbers plenty are hoping for. Having said that, the company usually manages to find a good deal, match you with the right car and the most realistic APR for your credit score.

Your Online Guide

So, what is it that you can get from their platform? Well, first and foremost, they will help you find a lender. For the most part, the process is really simple and straightforward. The user-friendly interface of their application will guide you all the way through it. First, you get to choose how much money you're looking to borrow and what type of vehicle you're interested in: car, van, motorbike, or a caravan motorhome. After that, you input your driver's license, your marital status, whether you have a valid passport, your age, and your employment status, the usual deal.

They'll ask you for your company and the position that you occupy at that company. Car License Deals claim that they would never contact your employer and we haven't been able to find a single complaint that states otherwise, so we're inclined to believe them. All of the questions after that are pretty standard. The application will inquire about your work experience (keep in mind that they only accept people with over 3 years of experience, so they might ask you to input your previous place of employment) and your monthly income, your address, and everything that's required to get you the best possible deal.

No Broker Fees

After filling out the application, all that's left for you is kick back, relax, and wait for the company to come back to you. More often than not, their representative will call with a decision in just a few minutes, so they won't end up wasting a whole lot of your time. Now that the unpleasant financial part is over, it is time to choose your car. Generally speaking, that's the fun part. There are lots of different dealers that offer a huge variety of options, so you should easily be able to find what you're looking for. But if you do end up needing some assistance, the company's trained specialists will be there to help you along the way.

Again, for the most part, we really like how the company operates. They will find you a suitable flexible deal and the best loan term. Based on your suggestions, the payments will be spread over a year or up to 60 months. On their website, you will find a comprehensive FAQ section that will definitely prove helpful. Their advertised 98% approval rate, as far as we can tell, is fairly accurate. They do not take a broker fee and they never match you with the companies that require a deposit beforehand.

Infographics

What Is a Car Loan?

Somehow, we reckon you have a pretty good idea of what a car loan is. The better question would be: what is it exactly that this car loan websites offer? Because, as you very well know, everything is online these days. So, why wouldn't you be able to get a car loan online? It is much easier and a lot more convenient. You get to save the time you would have otherwise spent driving to the bank. And, there's a very good chance you might get a better deal. Though we've decided to go with "car loans", this review doesn't just cover automobile loan services.

Instead, we have included a number of different platforms that, one way or the other, will help you find the best possible deal. Of course, as it is always the case with these loans, the best deal constitutes low interest rates, liberal loan terms, a short approval time, as few limits as possible on things like mileage and age of the car, and no ridiculous penalties. Some of the websites in this review do not necessarily issue the loan themselves but they will match you with a lender.

Got a loan and were finally able to acquire a new car? Good for you. Just in time to get yourself a new car DVD player or car speakers.

Your comment was successfully sent

Error! Please try again later